Smart BRIDGE

to the Future Trade

Smart BRIDGE

to the Future Trade

Smart BRIDGE

to the

Future Trade

Korea International Trade Association(KITA) was established in 1946 with the objective of advancing the Korean economy through trade, and is currently the largest business organization in Korea with over 73,000 member companies.

-

0

Domestic Offices

-

0

Overseas Branches

-

0k

Member Companies

-

0

Global Network

Introduction

Korea International Trade Association(KITA) is the largest business organization in Korea with over 73,000 member companies. It was founded in 1946 to bolster the Korean economy through global trade.

KITA News

Get the latest news and updates about KITA.

Video Clip

A trustworthy partner in creating a better future.

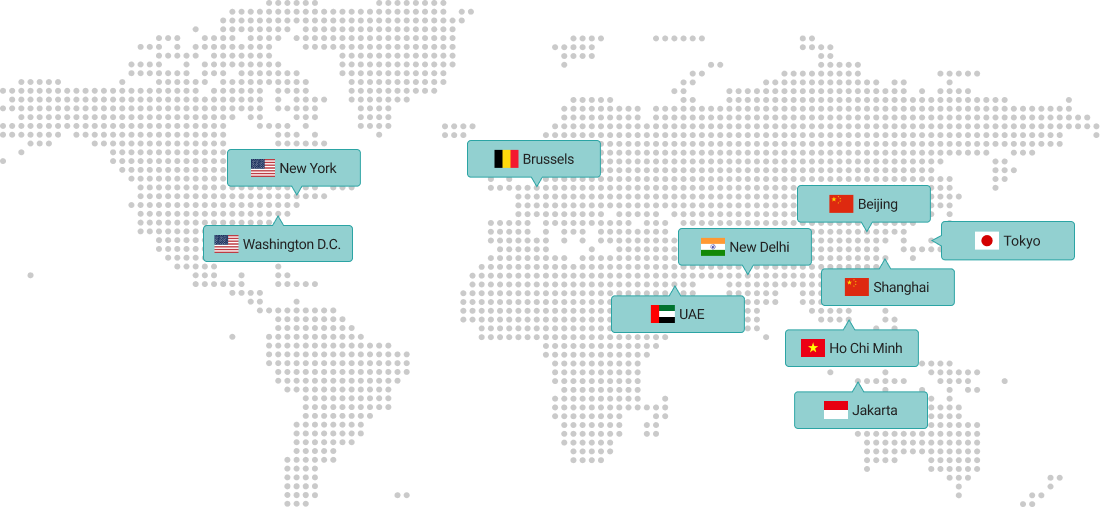

Overseas Branches

KITA is a leading business organization with a network of 13 domestic offices and 10 overseas branches in major cities.

KITA Business

KITA is the largest business organization in Korea with over 73,000 member companies.

-

Trade Policy Recommendation & Trade Consultation

-

Think Tank Specializing in Korea's Trade Strategy & Policy

-

Global Economic

Cooperation -

Education & Training :

Korea Trade Academy -

Buyer-Seller

Business Matching -

Find more about

KITA’s Core Business

-

Two way communication &

Business Support -

A bridge to foster cooperation

with global partners -

Working with 232 organizations

from 67 countries -

Ongoing management &

Regular communications -

Discover joint

business projects -

Find more about

KITA’s Global Networks

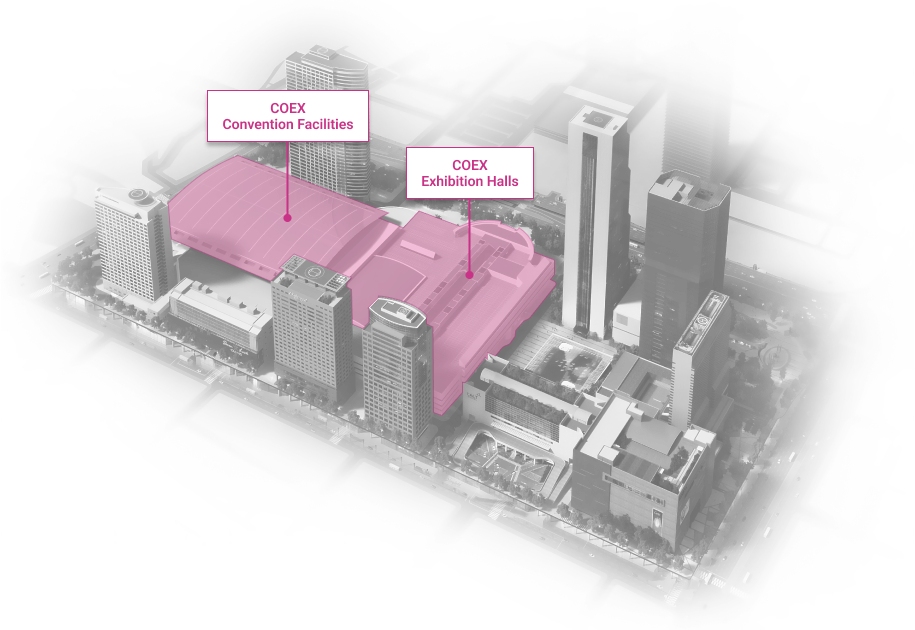

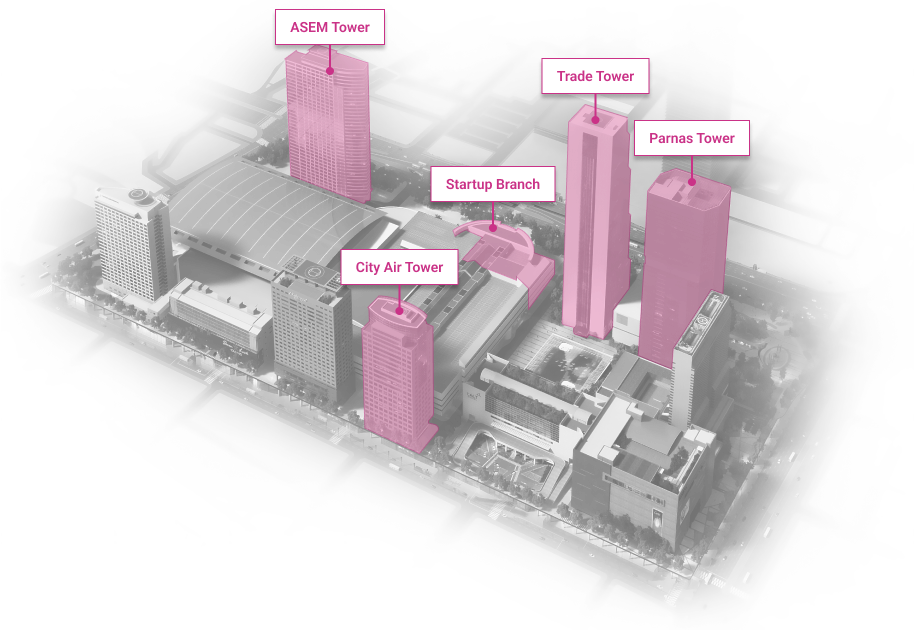

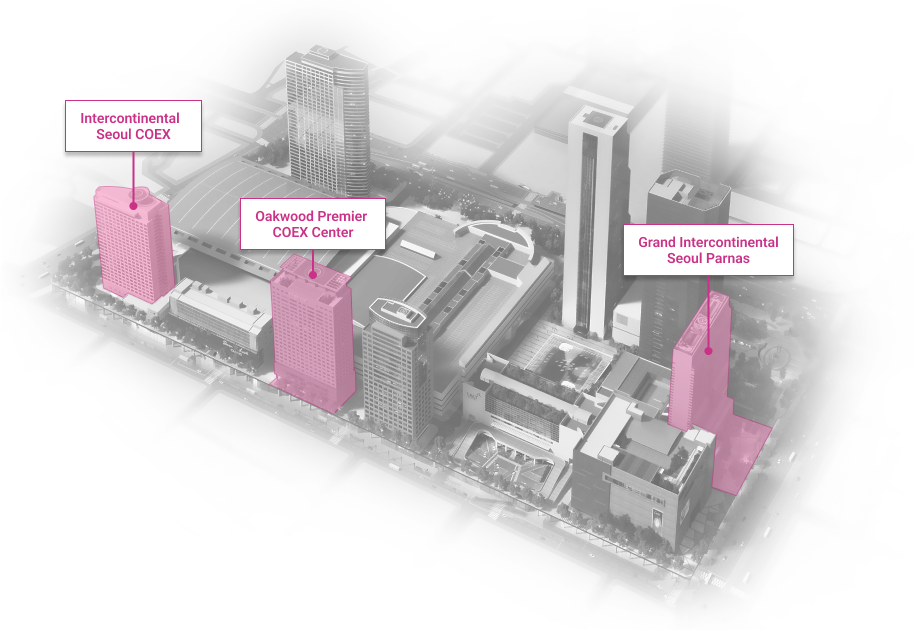

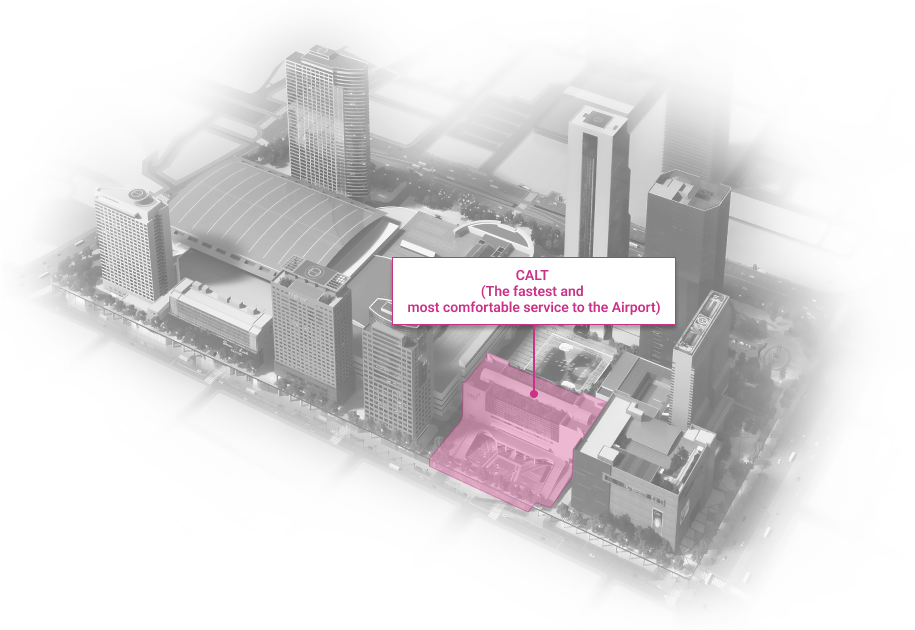

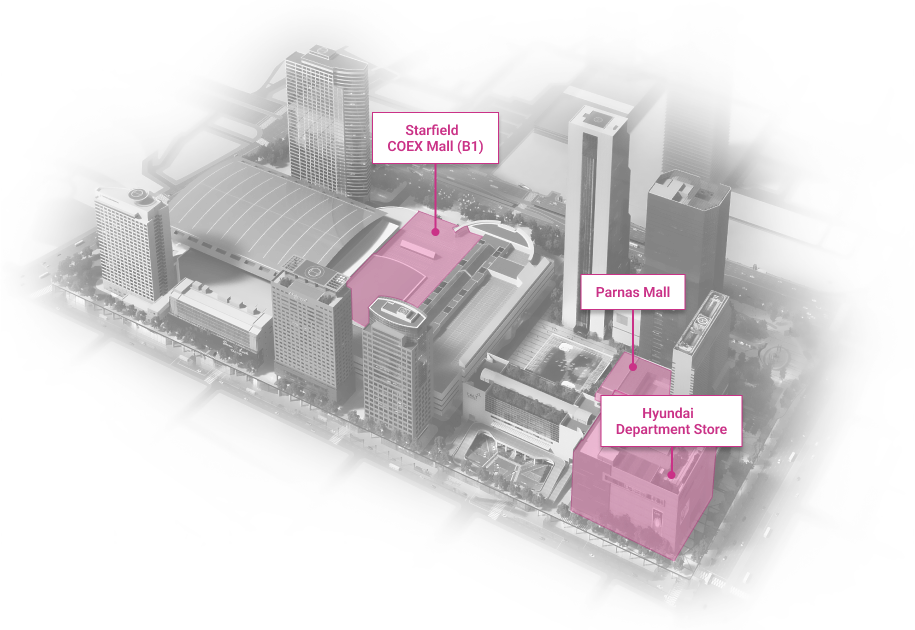

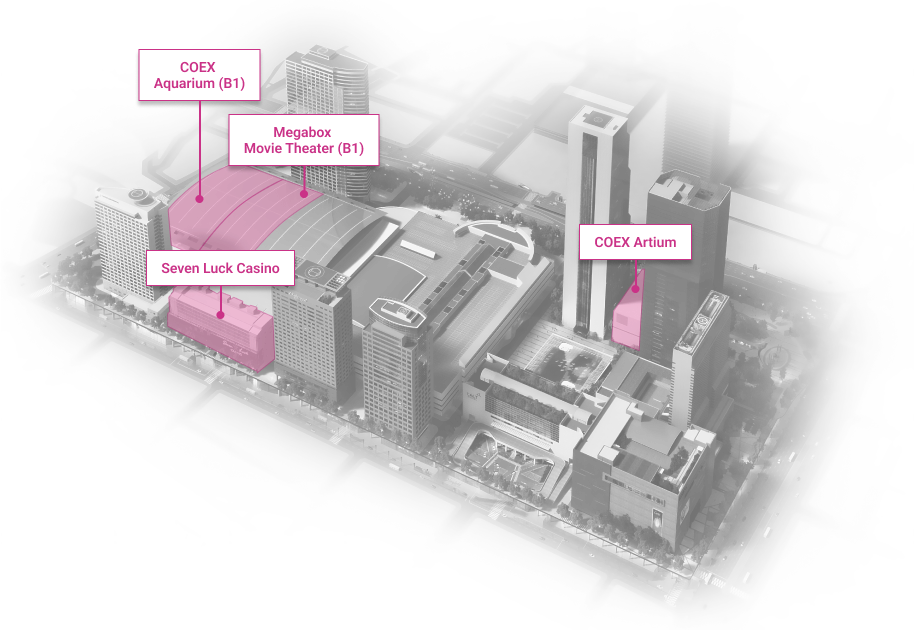

WTC Seoul

Development of an intrgrated trade, cultural & business center.

Location

Address

Trade Tower, 511 Yeongdong-daero, Gangnam-gu,

Seoul, 06164 Republic of Korea

Seoul, 06164 Republic of Korea

Telephone

(+82 2) 1566-5114